Tax Affairs Need Not be Taxing, An Article by Author John Holt

28 Tuesday Apr 2015

Written by susanfinlay

I often hear from people who want to write a book but don’t know how or where to begin. Or from people who have already written a book that’s ready for publication but don’t know how to get it published. I recently began a new blog series, Writing and Publishing Tips From Authors Around the World, to help writers.

The twentieth contributor is U.K. author John Holt and he’s here to talk about getting a taxpayer ID when self-publishing.

TAX AFFAIRS NEED NOT BE TAXING by John Holt

The following article is really intended for non-United States residents. In particular the article is meant for the author in Britain. It is possible that similar arrangements would apply to other European countries, but I am not sure. So additional checking would be advisable.

Dealing with the United States Treasury Internal Revenue Service need not be taxing, but if you don’t want to be paying tax to the United States then this article is very important.

Okay so you’ve written your blockbuster and it is now out there for sale. Now you can earn some money for all of that hard work you did. The months, years maybe, of struggling, to produce your epic. Maybe you didn’t write in order to make money, well that’s okay. And we can’t all be a budding J K Rowling, or a Stephen King, and earn millions. BUT …… yes sorry about that, but if you do earn some money – large or small – there’s a few things that you need to consider. No matter what price you pitch your book at there will be a few people looking for their share of the income. The main people are (a) your publisher (unless you are self published), he/she will want their share; (b) Amazon, or whoever is selling the book for you, will want their cut; (c) Lulu.com, or Createspace, or whoever produced your paperback; and (d) the main party will be the Tax Man.

In that connection there are two aspects that you should consider. Firstly, in the United Kingdom, any income might be subject to tax. People with taxable income up to £31,785 are basic-rate taxpayers and pay tax at 20% (with £10,600 personal allowance, this gives a threshold of £42,385) Those with taxable income over the limit pay tax at 40% on income above the threshold. Taxable income over £150,000 is taxed at 45%. That is assuming your total income is above the Personal Allowance.

The second thing to consider is that any sales on Amazon.com; Lulu.com, or Createspace, (all American organisations) will be taxed, automatically at source, at 30%. So if you sell one ebook for $1, your royalty will be approximately 35 cents, after Amazon have taken its share. BUT …. (sorry) Amazon will automatically deduct 30% tax payable to the IRS, so there goes 10 cents worth, and you haven’t paid your publisher yet. Now remember this happens automatically, whether you are a US taxpayer or not; or whether your earnings are $1, or thousands of dollars.

The only way to prevent this from happening is to register with the US Treasury IRS, for tax exemption.

TO REGISTER WITH THE US TREASURY IRS FOR TAX EXEMPTION ON ROYALTIES EARNED ON AMAZON, KINDLE DIRECT, LULU, CREATESPACE etc

The following steps should be taken (at least this is what I did)

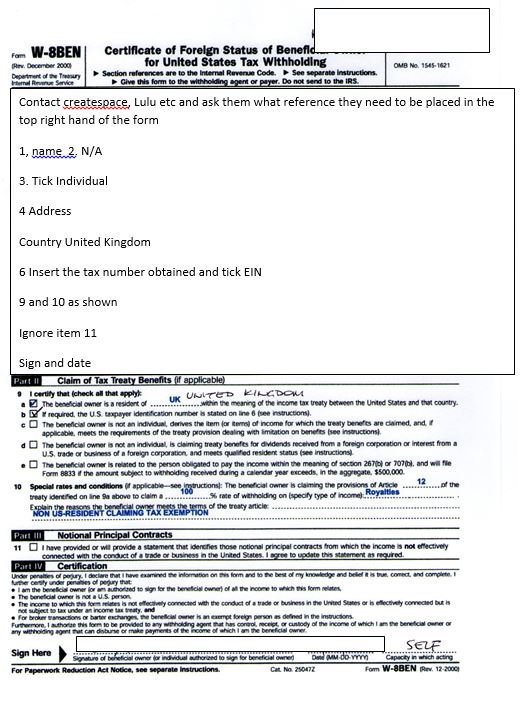

1. Set a name for your Self Publishing banner. It can be anything that you consider appropriate – your favourite animal, flower, colour; where you live; your husband/wife’s name. Mine was PHOENIX

2. Register the name with the HMRC. This can be done on line. http://www.hmrc.gov.uk/businesses/iwtregister-a-new-business.shtml

The form you need is a CWF1 – http://www.hmrc.gov.uk/forms/cwf1.pdf

Register a new business

I want to…

We recommend:

• Register a New Business

If you intend to start a limited company you must let Companies House know as soon as possible.

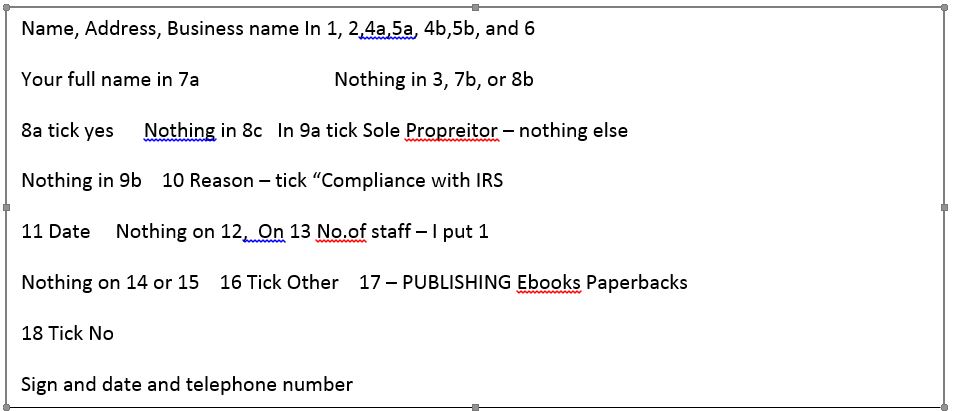

3. Next you need to fill out Form SS-4. This can be downloaded from IRS website. http://www.irs.gov/instructions/iss4/ch01.html

Then telephone IRS Philadelphia For information on where to file your tax return please see Where to File Addresses. The Taxpayer Advocate Service: Call (215) 861-1304 in Philadelphia or (412) 395-5987 in Pittsburgh, or 1-877-777-4778 elsewhere, or see Publication 1546, The Taxpayer Advocate Service of the IRS. For further information, see Tax Topic 104

(You can post it if you would prefer, it just takes a few weeks longer to sort out)

(If you telephone make sure you ring at about 10.00 pm UK time, (about 4.0 in the afternoon in the States)

You will be given an EIN on the telephone.

Send a copy to the each of the organisations that are selling your book

In the top right hand corner you must put the reference number for each of them

DU3WX for KDP

1318632 for Createspace

Of course if you do have a publisher, then they should do all of this for you.

UK TAX RETURN

Next you should consider what to include when you do your tax return. Certainly you include details of your income, your royalties – but only when the money is in your bank account. You should also include details of your expenses associated with producing your book. That might include payment to people for designing your book cover; for formatting; for editing; proof reading, marketing. It should also include any expenses in purchasing proof copies, or copies sent to your local library, or the British Library. (Which, by the way, is a legal requirement). I also include expenses relating to the fact of working from home. This would include things like an allowance for electricity; an allowance for use of the computer; paper, envelopes; and an allowance for using part of your home as an office.

Now I don’t profess to be an expert in this field and you may wish to find out more by doing an Internet Search, but it’s what I did. I hope this has been helpful and I wish you every success in whatever you do.

Author BIO:

I live in Essex with my wife, daughter, and our cat who adopted us. I qualified as a Chartered Surveyor in 1966, and for many years I worked in Local Government. In 1972 I was employed as a Senior Project Manager with the Greater London Council. I stayed with them until the GLC was closed down by the Thatcher Government in 1986. I then started my own Surveying practice, carrying out property condition surveys, and preparing architectural drawings. In 2004 I had a heart attack, and lost a few clients. I finally retired in 2008.

Like many others I’m sure, I always wanted to write a novel but could never think of a decent plot. Then we had a holiday in Austria, at Lake Grundlsee. The next lake, Toplitz, had been used by the German Navy during the way, to test rockets and torpedoes. There were rumours of hidden nazi gold. This became the basis for my first novel “The Kammersee Affair” first published in 2006.

This was followed by five novels featuring my private detective Tom Kendall – The Mackenzie Dossier, The Marinski Affair, Epidemic, A Killing In The City, and Kendall. Then came “The Thackery Journal” a what if novel set during the American Civil War,

Recently I have been writing a series of novellas featuring a new private detective, Jack Daniels. To date two are available, The Candy Man and A Dead Certainty. A third, Trouble In Mind, should be available in April.

http://www.amazon.co.uk/Dead-Certainty-Jack-Daniels-Novella-ebook/dp/B00UP2S4EC/ref=asap_bc?ie=UTF8

http://www.amazon.co.uk/Kendall-Book-5-John-Holt-ebook/dp/B00LGZYZHW/ref=asap_bc?ie=UTF8

http://www.amazon.co.uk/Kendall-Private-Detective-Box-Set-ebook/dp/B00GRWTXHG/ref=asap_bc?ie=UTF8

http://www.amazon.co.uk/Epidemic-Kendall-Book-John-Holt-ebook/dp/B00BS9AIH2/ref=la_B003ERI7SI_1_8?s=books&ie=UTF8&qid=1427373400&sr=1-8

http://www.amazon.co.uk/Thackery-Journal-John-Holt-ebook/dp/B00EFALJCE/ref=la_B003ERI7SI_1_10?s=books&ie=UTF8&qid=1427373400&sr=1-10

http://www.amazon.com/John-Holt/e/B003ERI7SI/ref=sr_tc_2_0?qid=1427373514&sr=1-2-ent

![John Holt[1]](http://susanfinlay.com/wp-content/uploads/2015/04/john-holt1.jpg?w=262)

![DSC_0055[2]](http://susanfinlay.com/wp-content/uploads/2015/04/dsc_00552.jpg?w=300)

![Casebook%20Advert1[1]](http://susanfinlay.com/wp-content/uploads/2015/04/casebook20advert11.jpg?w=300)

6 Comments

April 28, 2015 at 1:43 pm

Thanks Susan – hope this is of interest and value to your readers.

April 28, 2015 at 1:48 pm

You’re welcome. I’m sure it will be helpful to many writers. Thanks for sharing it, John.

April 29, 2015 at 12:43 pm

I enjoyed your article and will be reading your books soon. Thank you for sharing your insight on writing.

April 30, 2015 at 1:30 pm

Thanks so much. I eventually managed to get the EIN a while back. Just one query. I’ve read that you only need to register your business in the UK if you make a certain amount of money a year (that is well above what I’m making with my writing and translating at the moment). I guess there is no harm in registering anyway, but wanted to make sure it wasn’t a requirement.

May 2, 2015 at 6:30 pm

Reblogged this on Chris The Story Reading Ape's Blog and commented:

UK Authors particularly should take note 😀

May 2, 2015 at 9:29 pm

Taxes. Taxes. Interesting reading and good to know. Thank you for sharing.